Divine Info About How To Start A Retirement Fund

In your 20s, as you start your career and make real money for the first time, your spending changes.

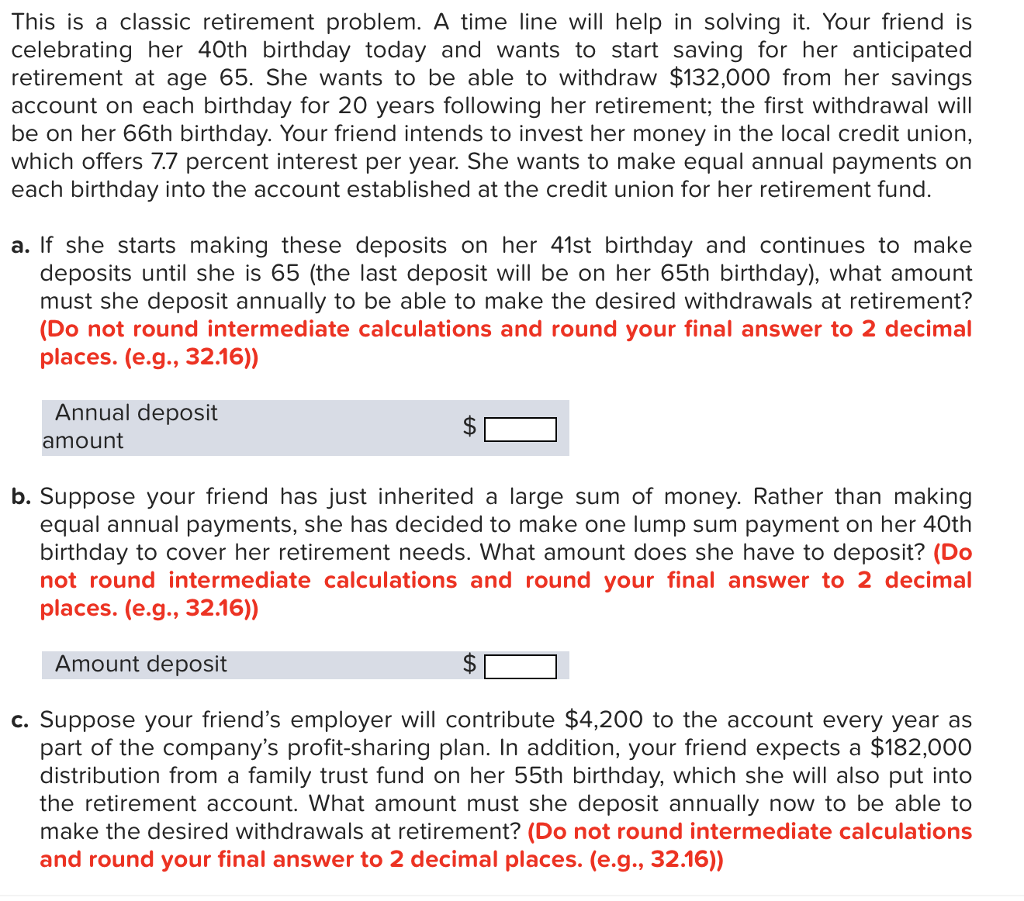

How to start a retirement fund. This primer will get you started on the main sources of funding when you retire. The first asx retirement share to look at is lifestyle communities. According to the social security.

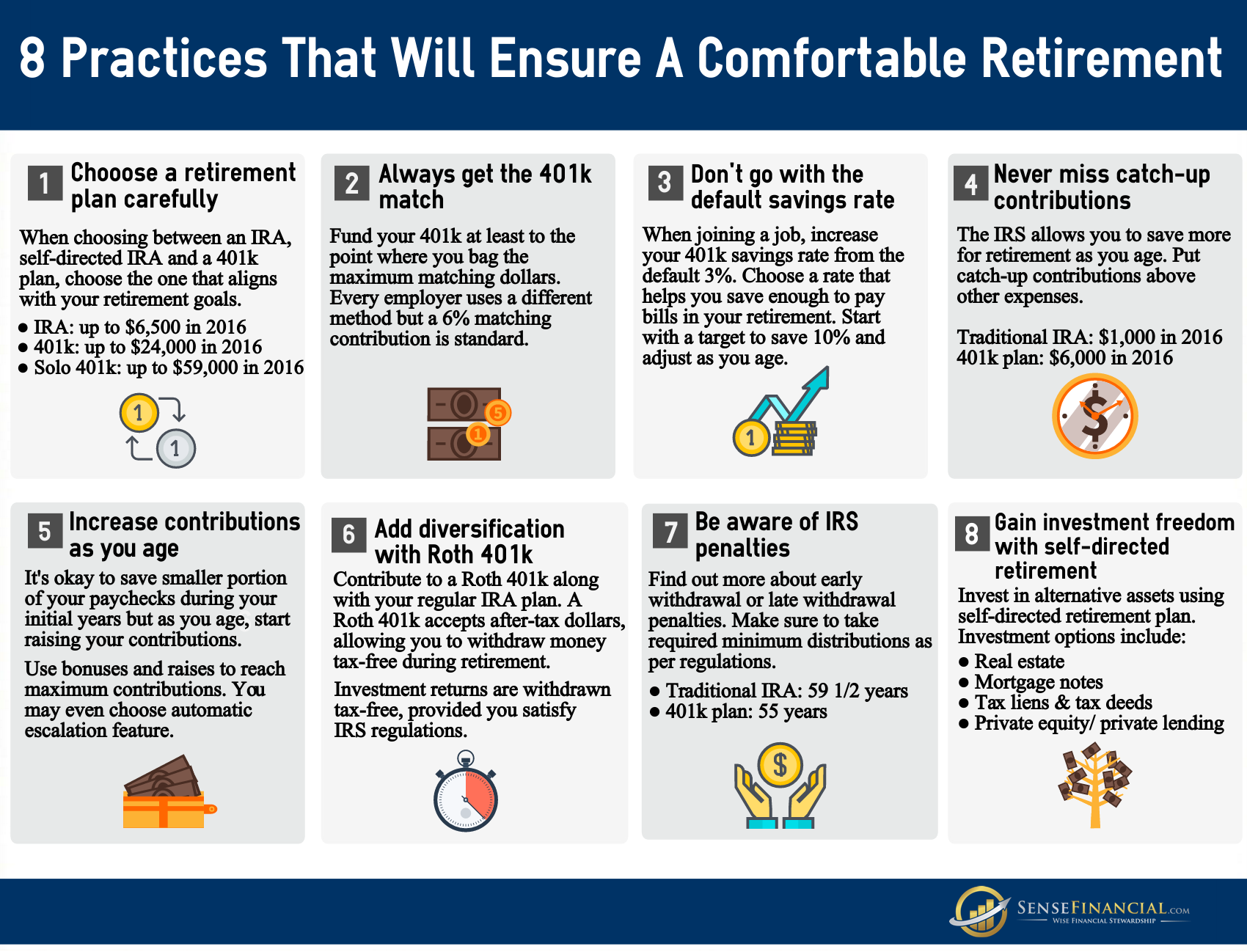

The key to successfully building your retirement fund is to contribute to it consistently over a long period of time. The best way to avoid getting caught up in wall street's hype machine is to start broadly and then slowly start to dip your toes into buying individual stocks. Designate a portion of your paycheck as retirement savings each month and have that amount automatically deposited into a.

There's certainly a risk that the price will fall, but odds. You might feel guilty if you're getting started. If you earn money, you pay social security taxes, but the funds used to pay social security benefits are expected to become depleted.

After living with your parents or in a college dorm, you can afford. The further away you are from retirement, the fund will. Know your retirement needs when planning for retirement, think about your goals.

To build an investment portfolio for retirement, choose your tax strategy and account, quantify your time horizon and evaluate your tolerance for risk. If you're between 55 and 64, you still have time to boost your retirement savings. For example, you are currently 28 years old and you want to retire at 55.

As you do not need income from your retirement corpus, it makes sense for you to invest the same in a safer broader index or hybrid fund. You have 27 years to collect your retirement fund. A basic index fund (a fund that matches a popular index like the dow jones industrials or s&p 500) is a good place to start;

How much money will you need based on the lifestyle you’d like to have?. It is a developer, owner and manager of affordable independent living residential land lease. Start by increasing your 401 (k) or other retirement plan.

Some individuals feel tempted to play “catch up”. Learn how to pull your resources together to meet your retirement goals. The first step in starting a retirement fund is determining the amount of money you will need for retirement based on your desired lifestyle and future expenses.

Consider an automated savings plan: