Exemplary Tips About How To Write Expense Report

Why do we need expense reports?

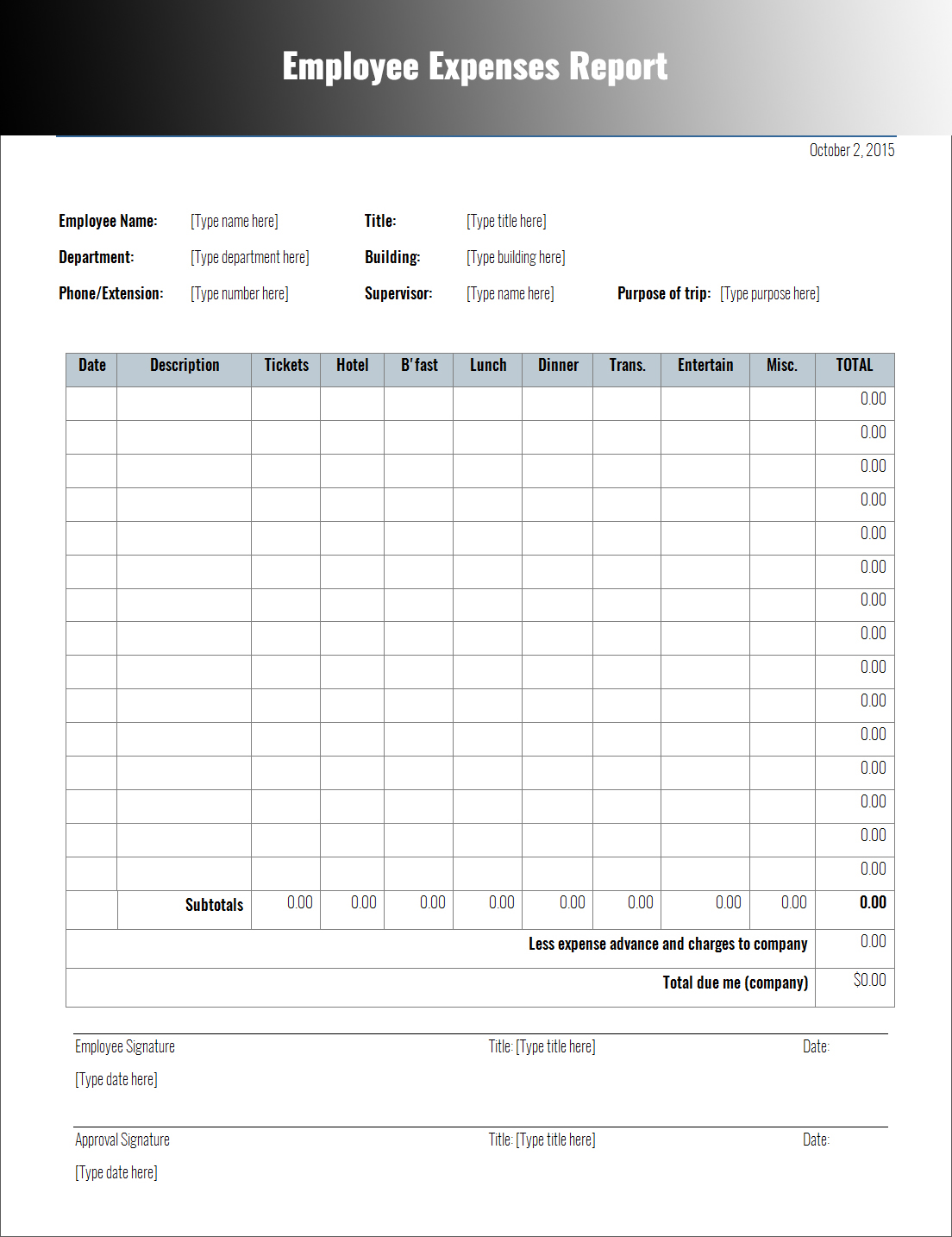

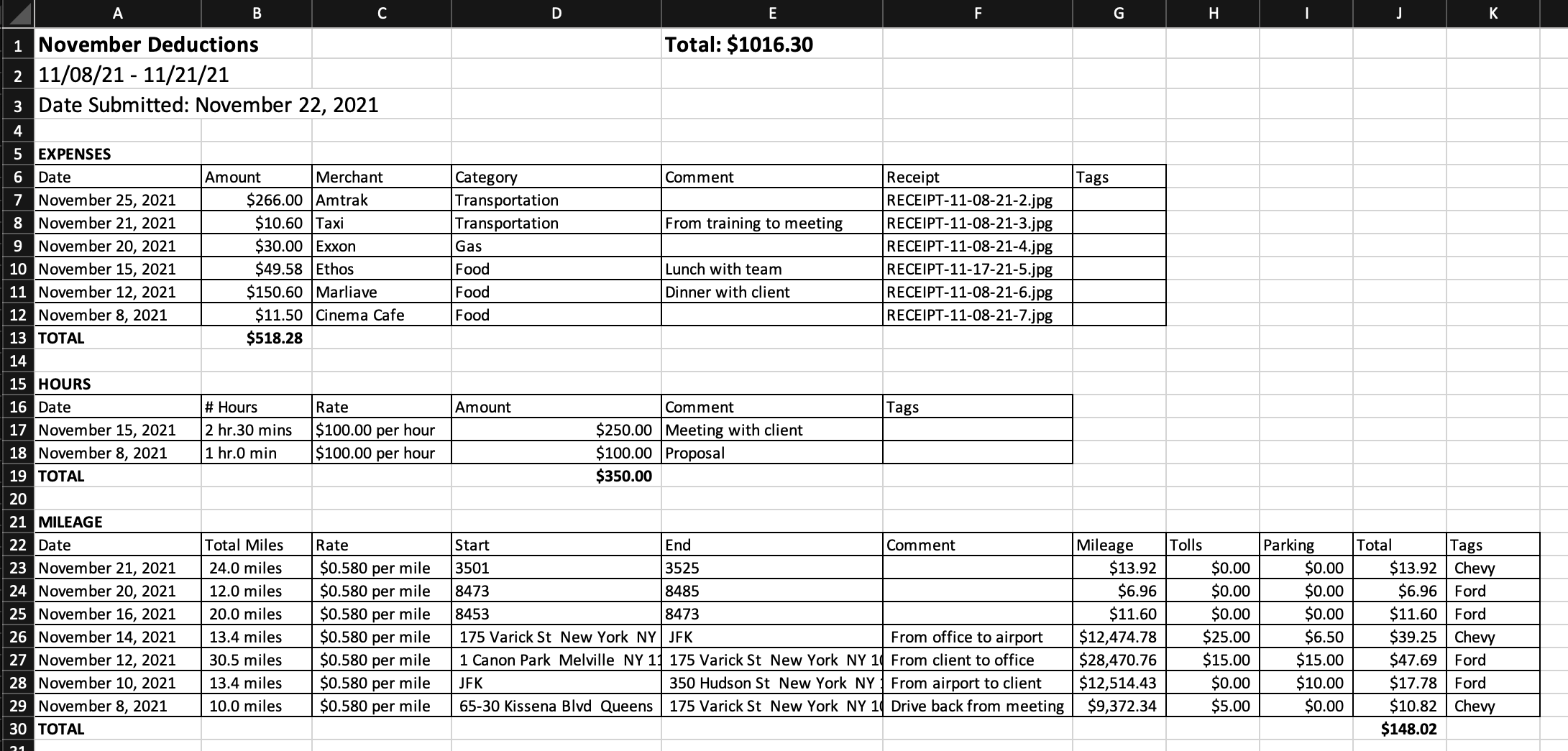

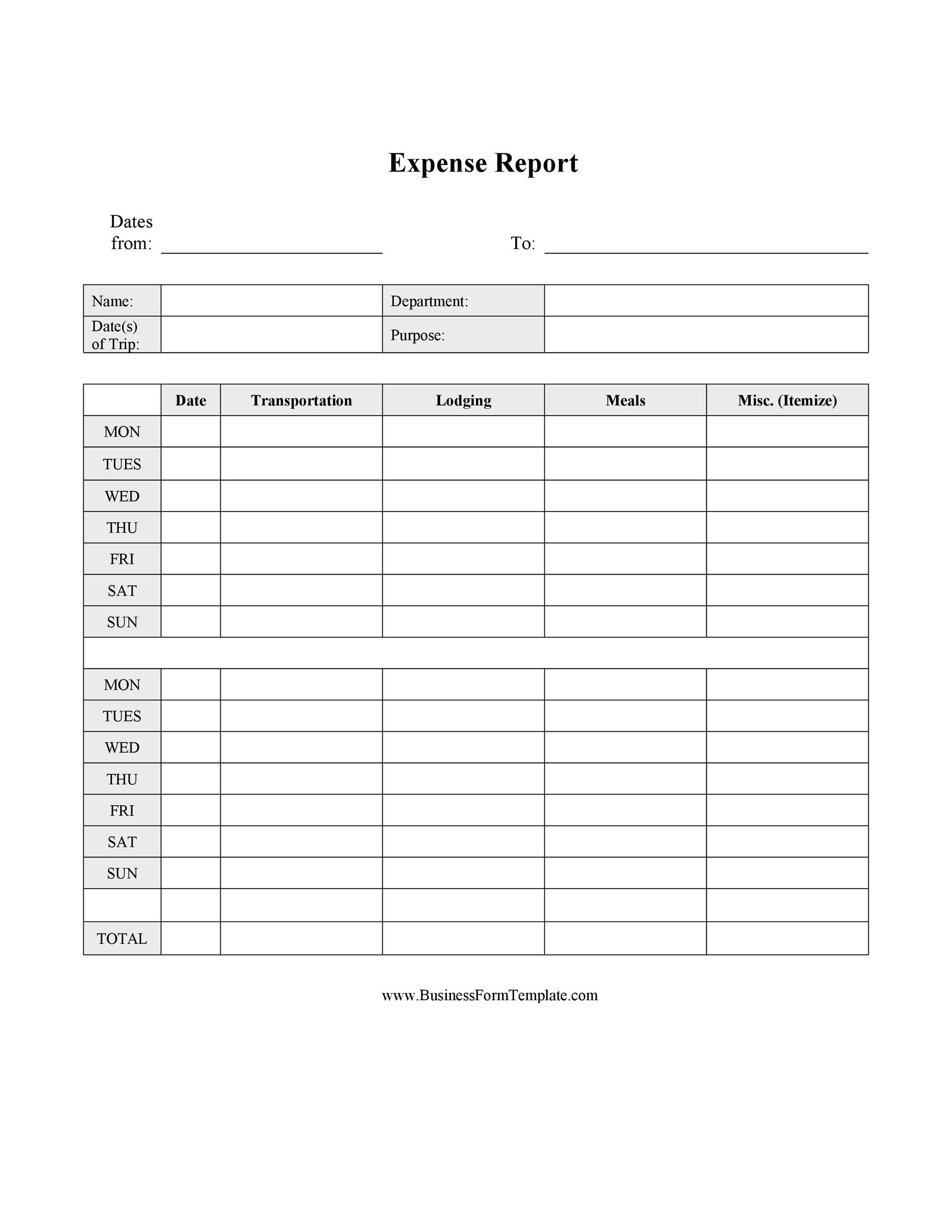

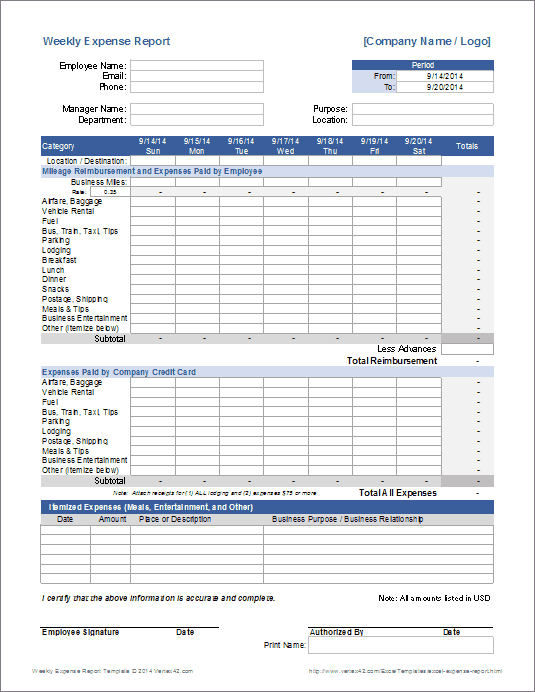

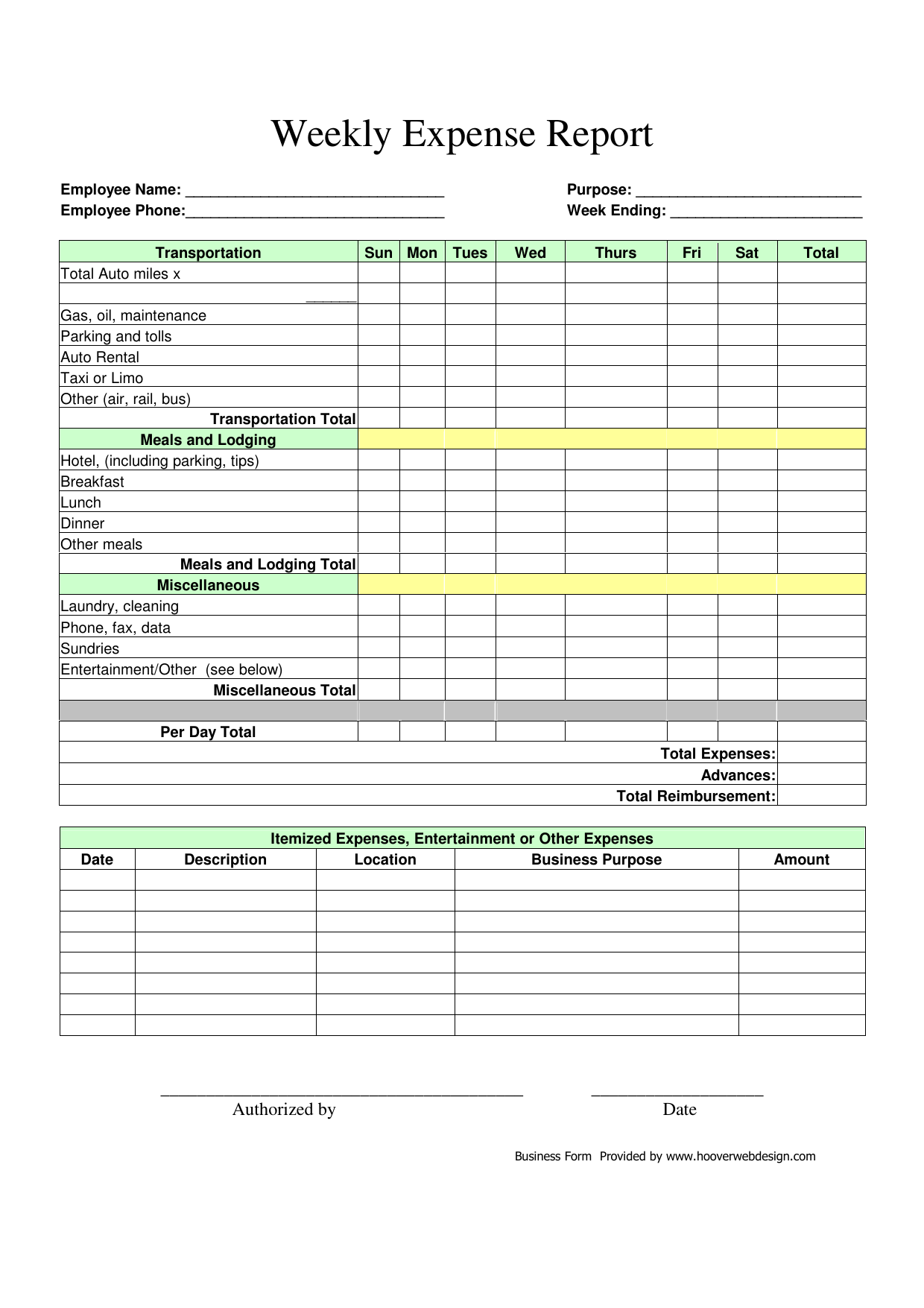

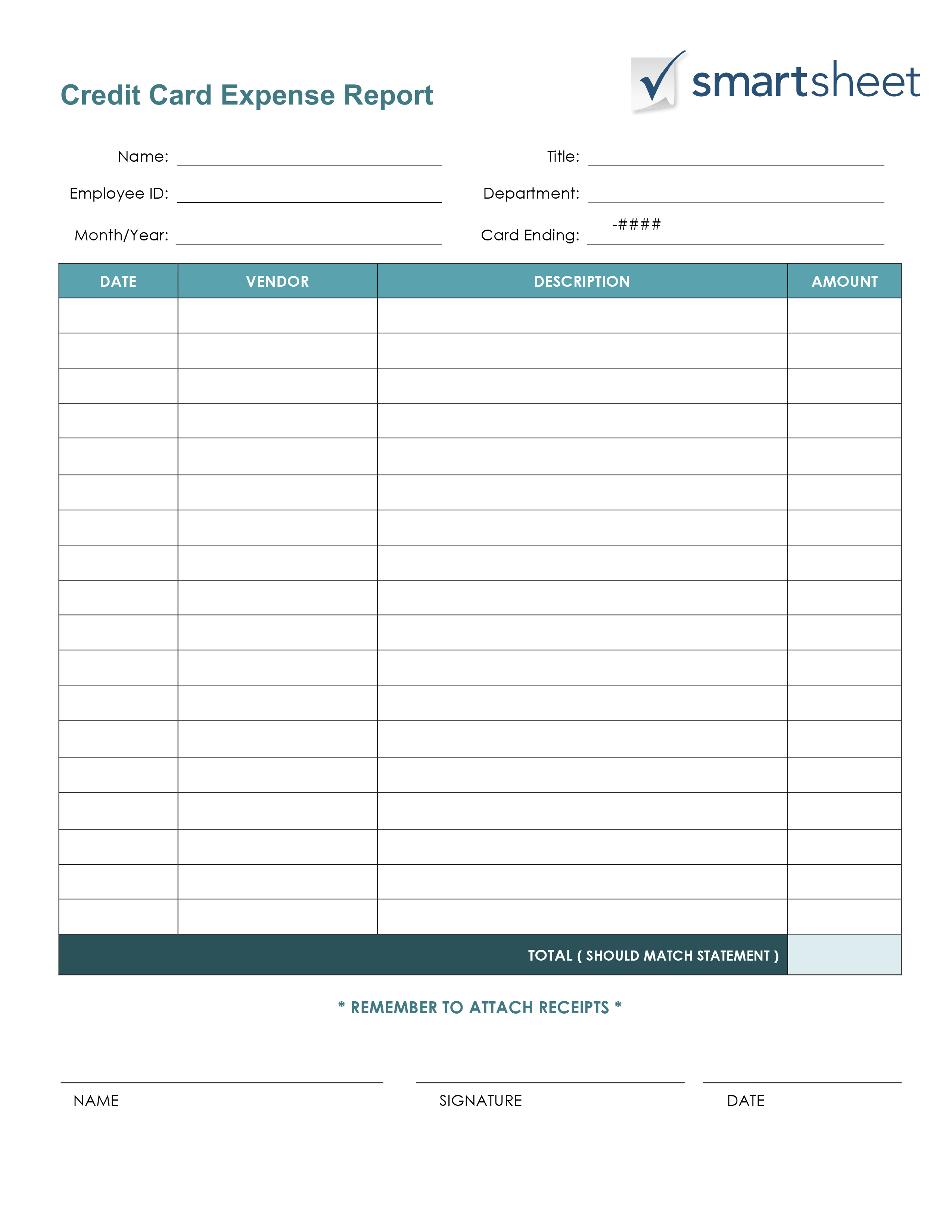

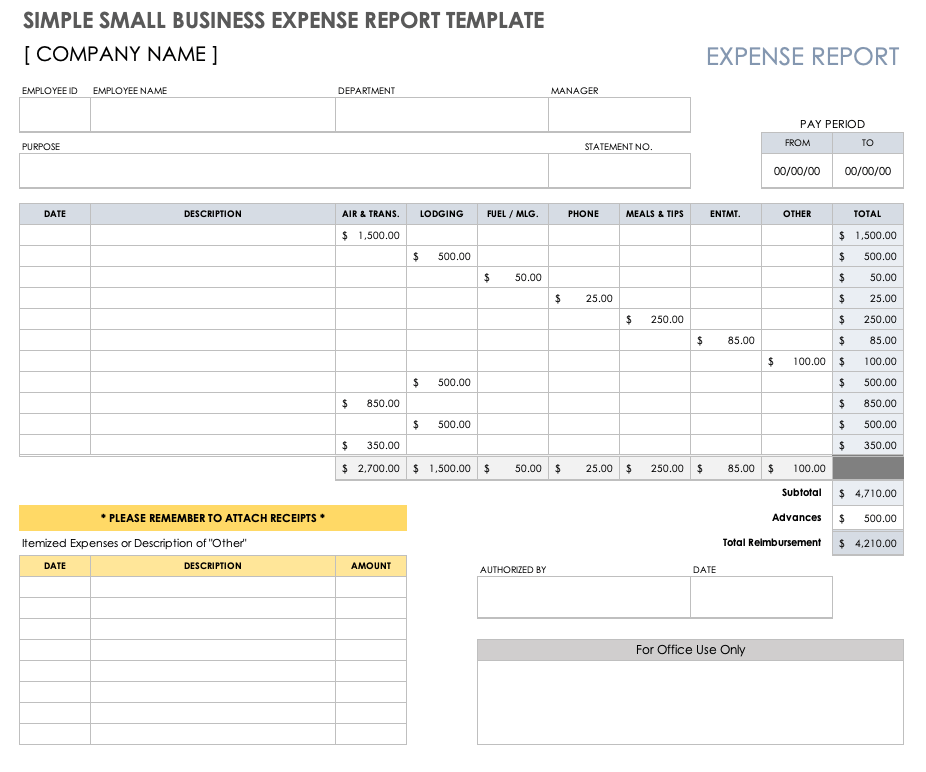

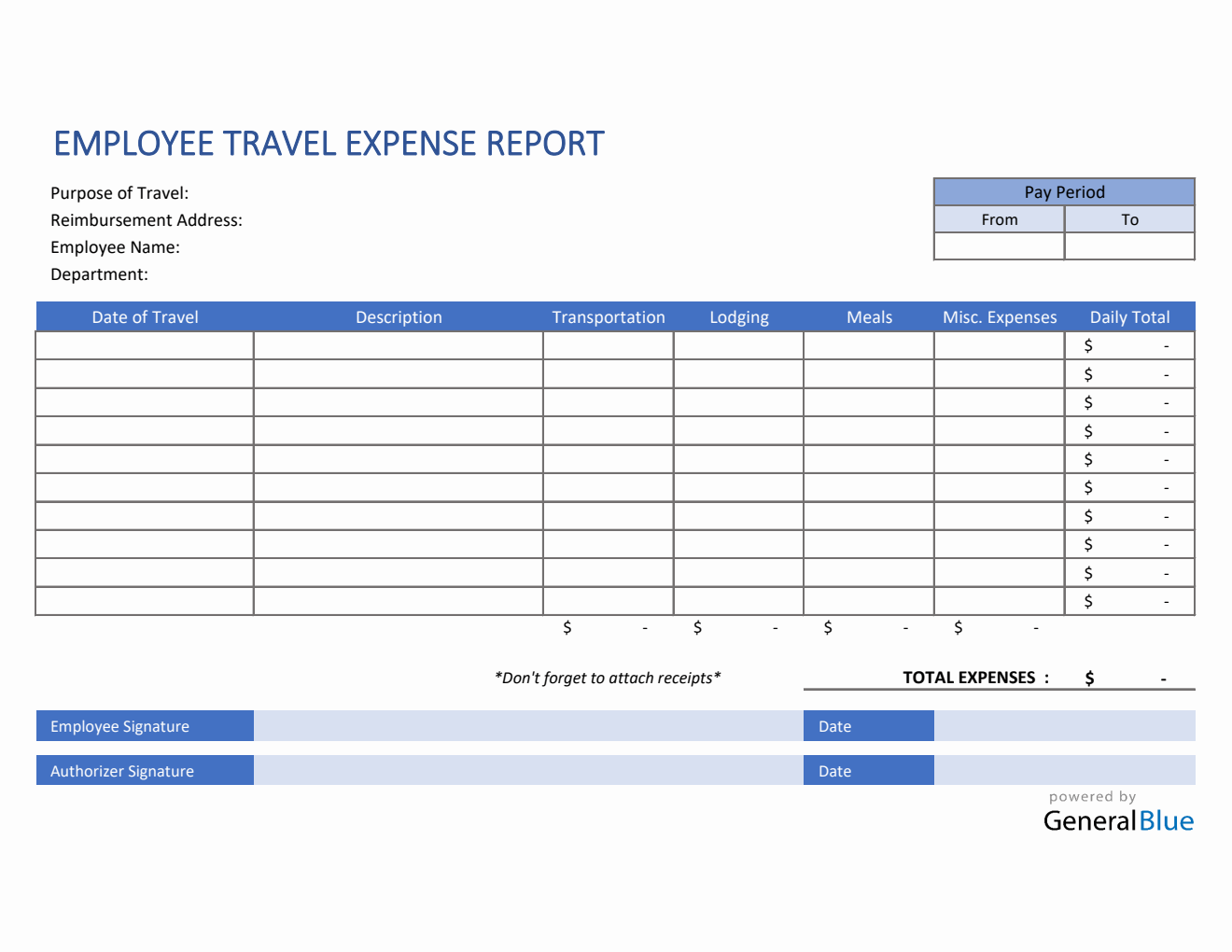

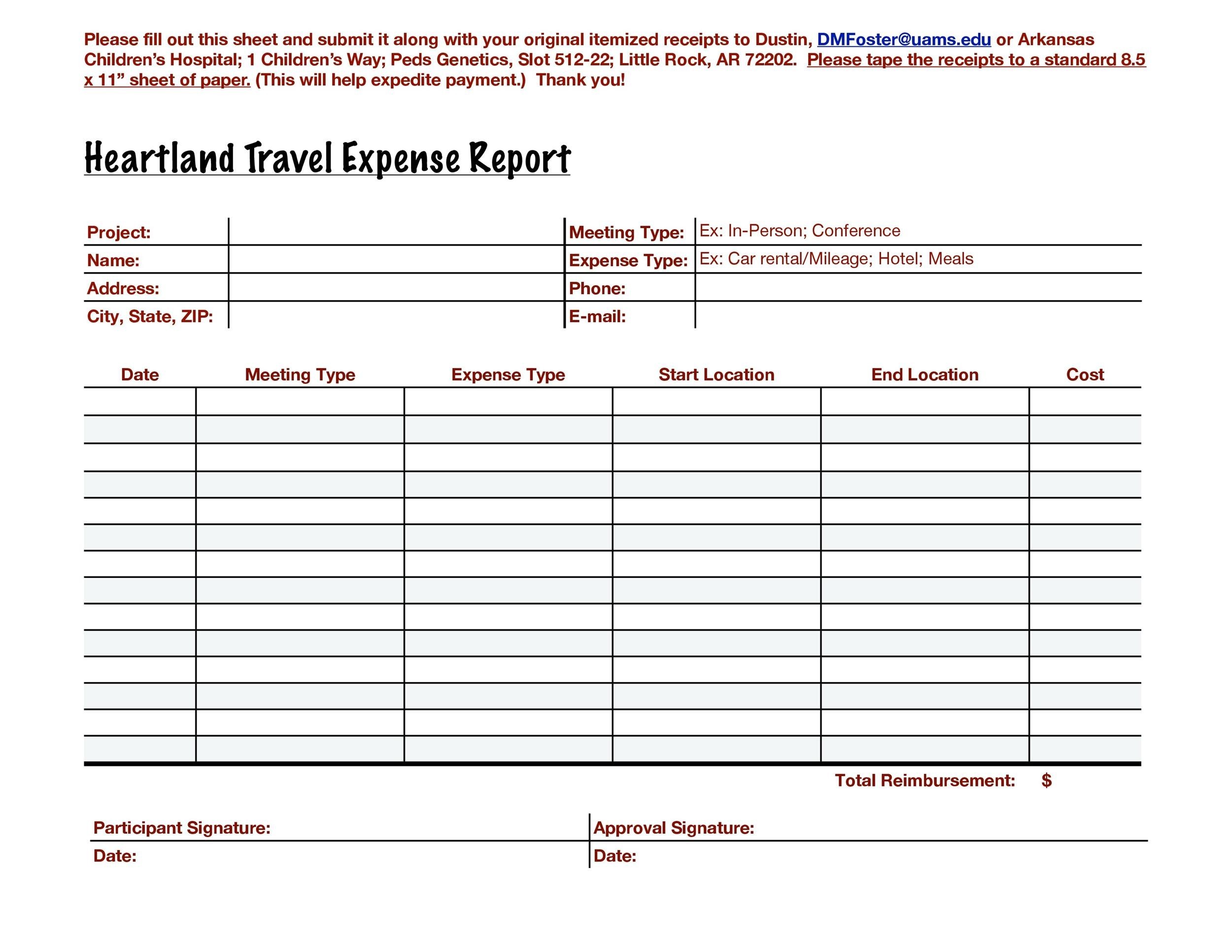

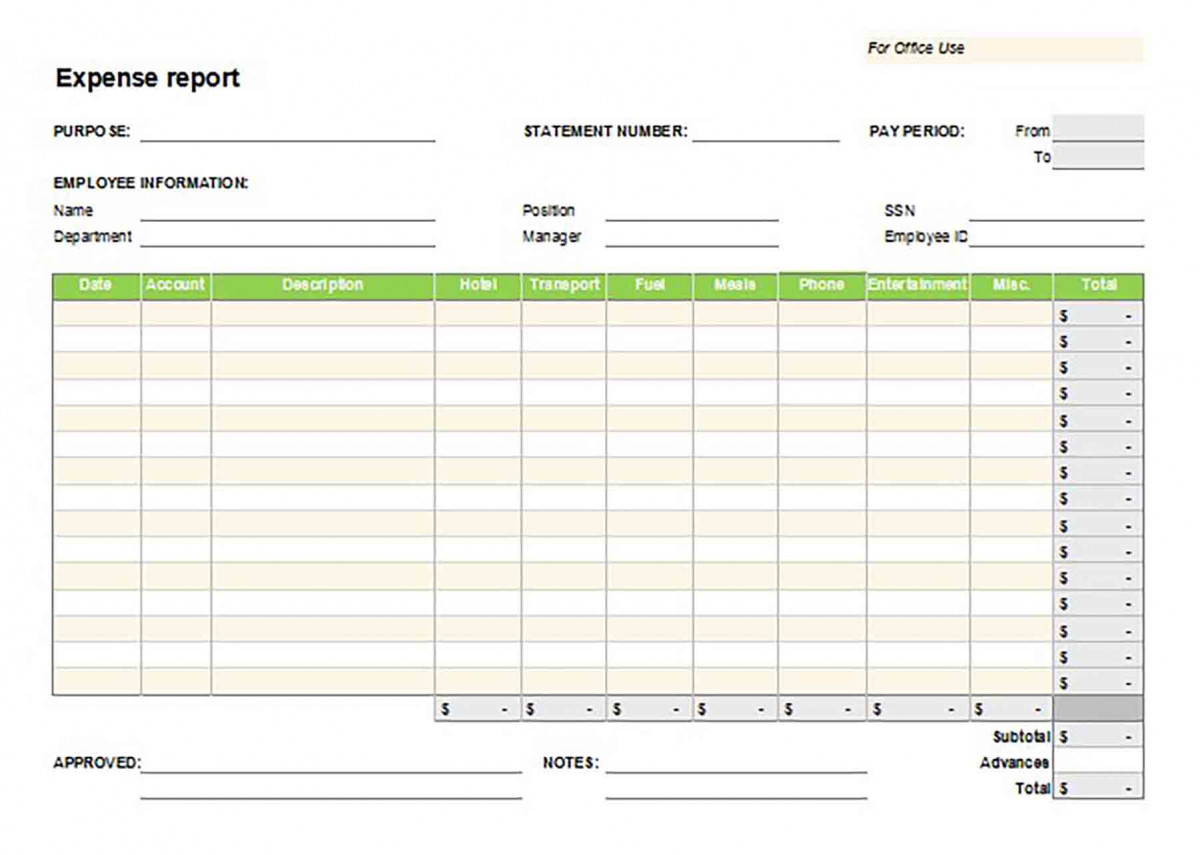

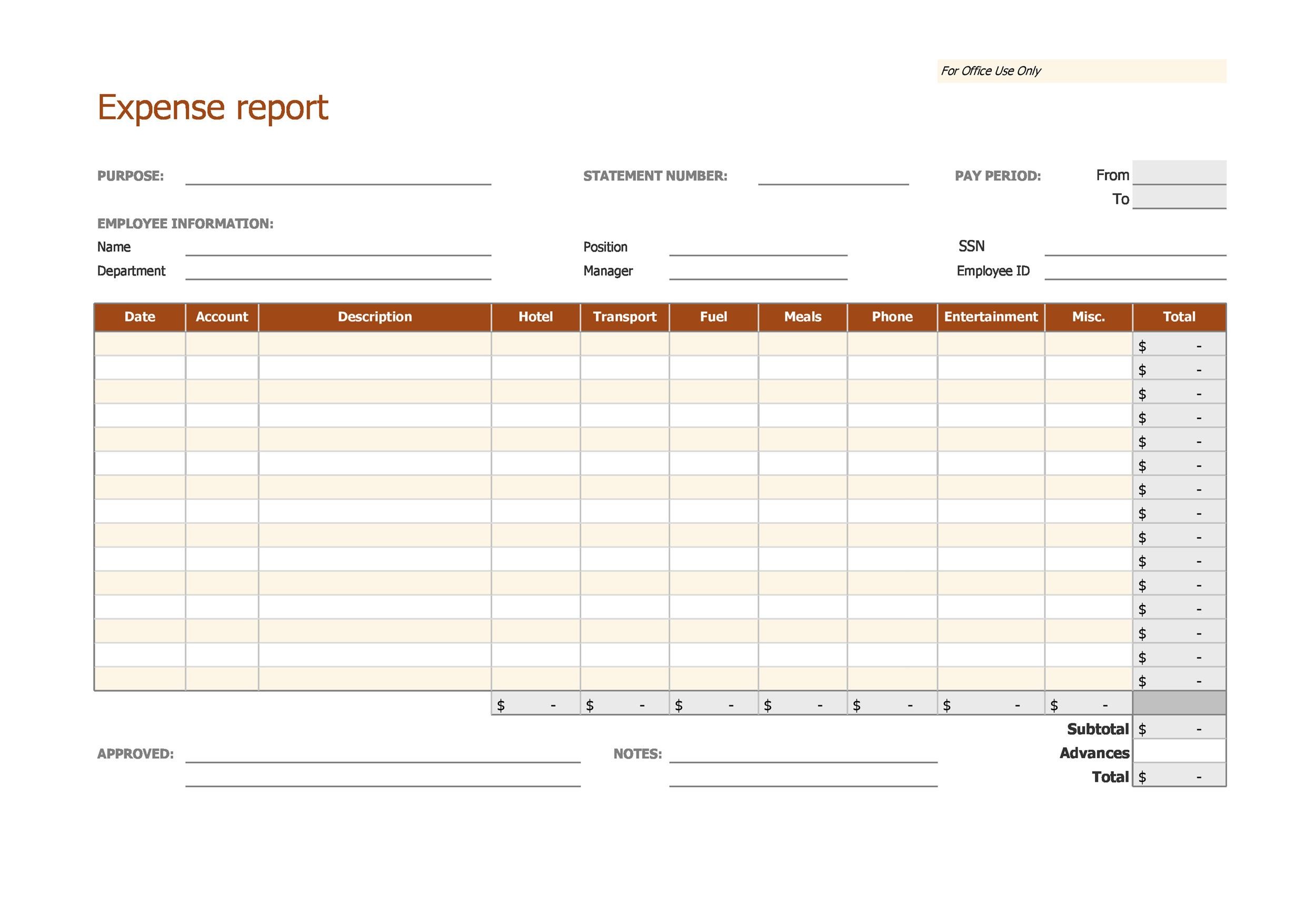

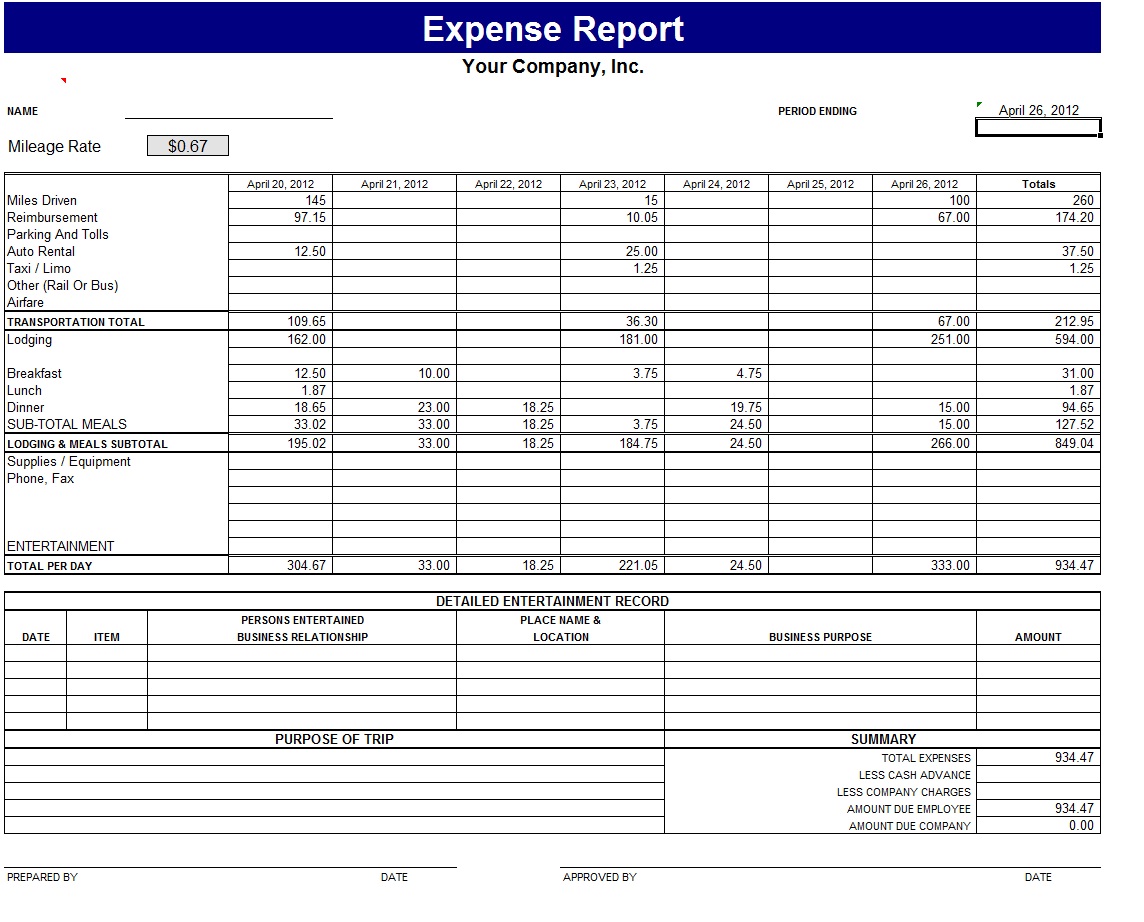

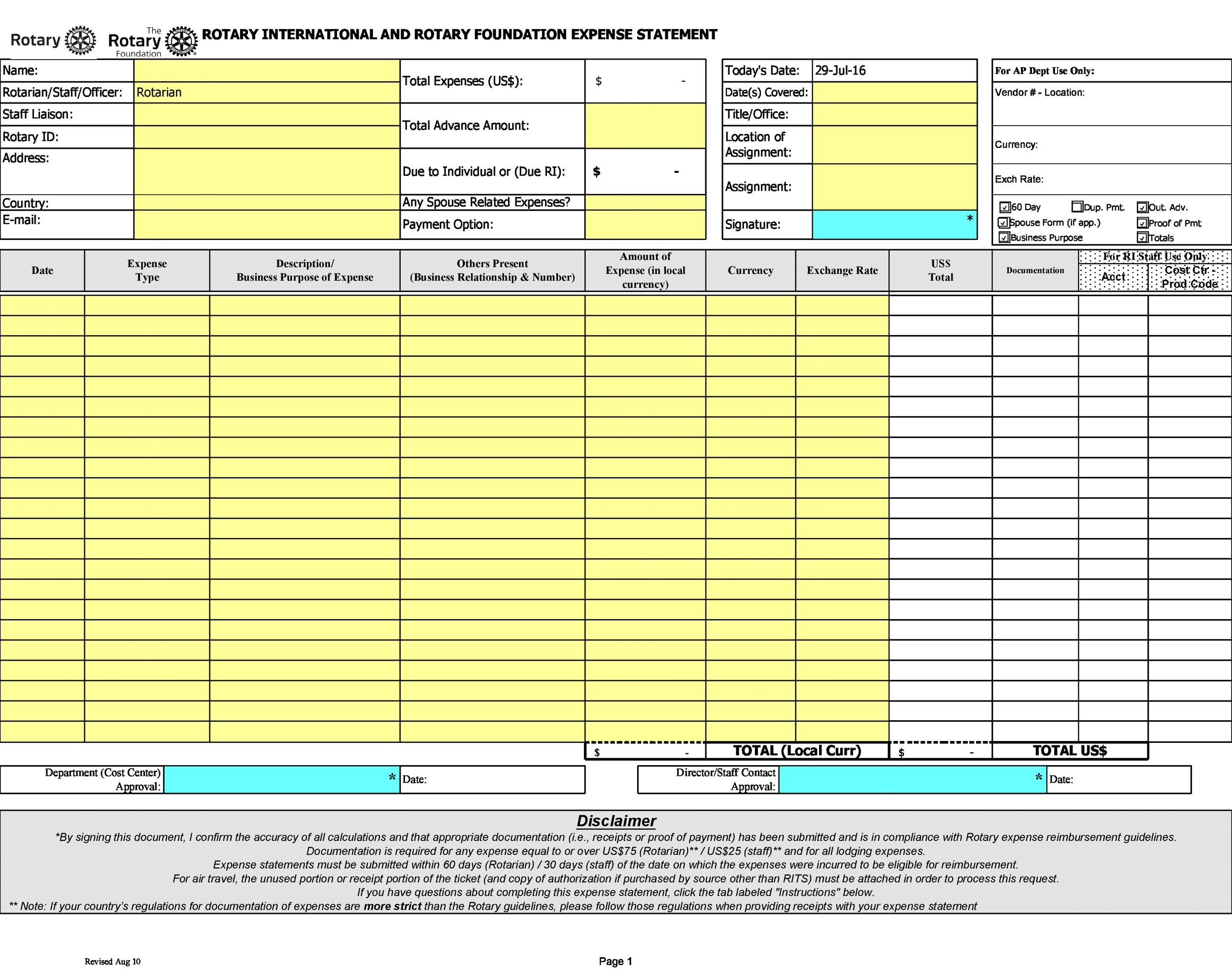

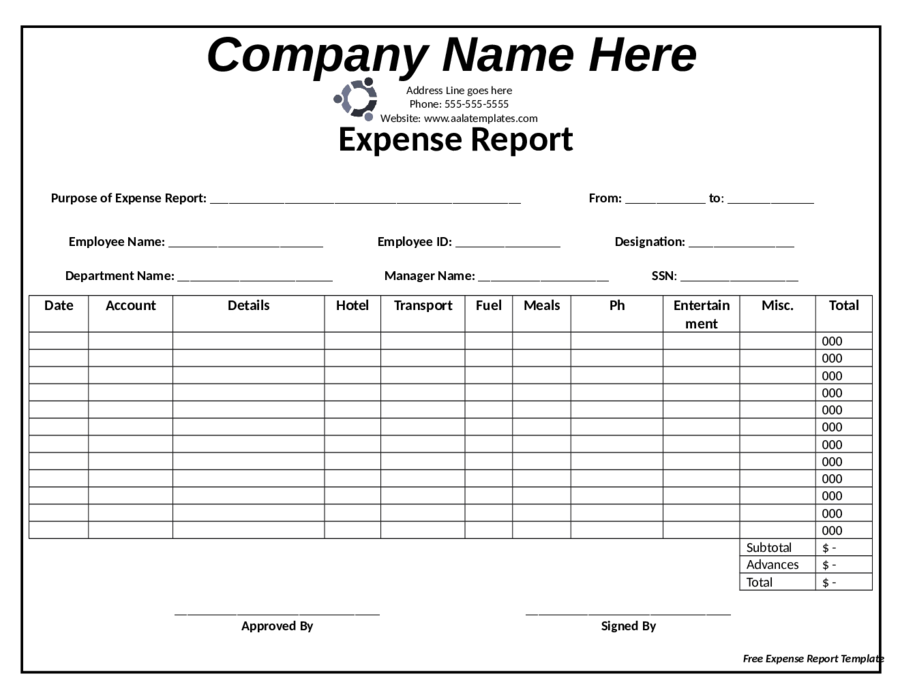

How to write expense report. An expense report is a summary of expenses categorized based on various criteria, such as project, department, or employee. A guide for small businesses. This report helps the employer or finance team determine.

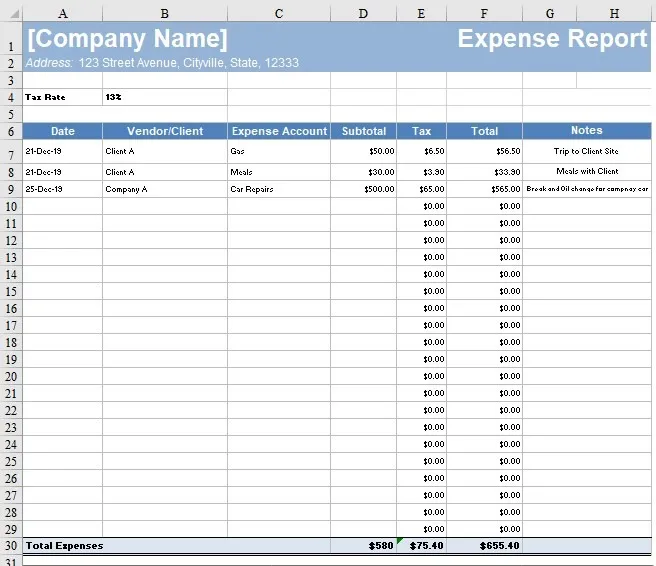

You can write an expense report in several programs and formats, including microsoft word and excel. Different businesses include different things in their expense reports. Monthly income and expense template.

6 steps to create an expense report: Ippr report says illegal migration act risks indefinite detention at taxpayer expense of people who cannot have their claims processed rishi sunak’s asylum laws. Expense reports should display the information needed to reimburse the spender and track the expense.

Here’s what to know about trump’s massive civil judgments. In this article, we define what an expense report is, discuss how to create them, highlighting what to include, explaining why it's important, and providing tips, a. 6 steps to create an expense report:

Done properly, expense reports allow businesses to receive tax deductions for reimbursements to employees. Most accounting software applications do not offer the ability to create an expense report. Steps to creating a basic expense report.

What to look for in a top expense report. If you use excel, you may hear the term “expense sheet” used instead,. Start creating for free.

Navigating the complexities of financial management can be a daunting task, especially when it comes to tracking expenses. An expense report contains a categorized and itemized list of expenses that were made on behalf of the organization. Here's a brief overview of the process:

03 january 2024 | 8 min read. If you use a portion of your home exclusively for business, then you can often claim the. Here are the top 25 small business tax deductions:

What is an expense report? The fifth step to creating effective expense report policies and procedures is to monitor and audit your expense reports on a regular basis. This is where expense reports come in.

Wages and benefits. Expense reports must include the exact date and amount of the incurred expense. For example, suppose your employee is traveling.